These are uncertain times. Fear of sickness and fear of financial ruin abound. Many people across the globe are in quarantine. Many are staying home as suggested not for themselves but for the sake of all those at risk. They are doing their part to slow the spread of disease. They are selfless individuals willing to sacrifice even to save a few that they may not know. The slower this spreads the fewer people at a time will need intensive care. It is for them we stay home now.

How does this all impact travelers like us who are full-time nomads? How do the falling markets impact those who retired early? Click the video above to find out.

What to do while you’re practicing social distancing

Free online learning offered now:

- Education: Take one or more of the 450 Ivy League courses currently being offered for free

- Enroll in the ChooseFI Academy and increase your understanding of personal finance – maybe even start your own journey towards financial independence.

Do some virtual travel:

- Travel Australia or South America with us, see “destinations” in the menu above

- Do a virtual tour of Six Italian Museums

- Go to Google Earth and travel through a few national parks. The geological landscape always fascinates me.

- Plan your next vacation. Dreaming is a beautiful thing

- Distract yourself with videos from one of my favorite fellow travelers from Travel is Life

Financial Planning:

Whether your are currently living paycheck to paycheck or already in retirement, if you want to improve and learn more about how to handle money better, then enroll in the ChooseFI Academy for free. Below is my one tip for today on the art of waiting that I mentioned in the video above.

The Art of Waiting

Fear of job loss is real especially if one is paycheck to paycheck. To reduce or even eliminate that fear, the cycle has to be broken. Our paths are all different, but one single thing that can make a difference in each person’s financial future is the art of waiting.

Waiting to Purchase

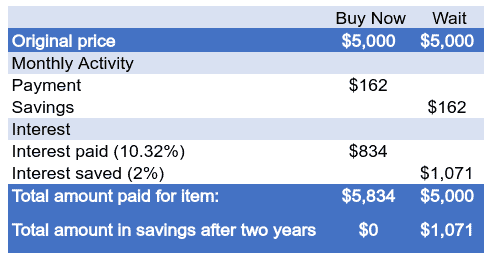

According to the Federal Reserve the average interest rate for loans on furniture is 10.31%. This means that a loan of $5,000 for furniture paid off in two years results in over $800 extra in interest payments. That means that the consumer would have paid a total of $5,834 for that furniture.

What if that same consumer waited to make the purchase and instead made those same payments to himself for that two years? At the end of two years he can pay cash for the furniture and also have over $1,000 in savings.

Both options show the same monthly payment, but waiting enables the consumer to start getting ahead instead of continually falling behind.

Loans make the poor poorer. Sometimes debt is necessary and it can be extremely difficult to change this spiral. It is okay to ask for help from others to organize your finances. It can also help to join online or in person groups who desire to also get out of debt. They can help keep the motivation going.

The point of this illustration is that that waiting can move a consumers finances past the tipping point of a paycheck to paycheck existence. It can build in enough savings to start paying cash for consumables – ultimately paying less for everything. Once a consumer is past this point, the savings can begin to compound exponentially.

Re-evaluate need

I don’t advocate for a lifestyle of complete self-denial living on only rice and beans. I do believe that self denial for a short time however can help move the dial from one of ever increasing debt to one of increasing savings. Sometimes doing whatever it takes to get past that tipping point is necessary.

Having enough in savings means that loans with a horrible interest rates won’t be required for everything that might go wrong. It’s getting to the point where paying cash is an option. It means that the consumer will begin paying less for everything making it even easier to save more and start getting ahead.

The tipping point is when a consumer gets to keep interest on their own money instead of paying it out on debt. It is when compounding interest begins to work for you instead of against you.

Getting out of debt reduces fear (real fear, not just imagined). It is a huge relief knowing that you can go without work for a short time and not lose everything you have or be taken to collections. In calmer times it also lets an employee say goodbye to a boss who is a jerk.

Debt can be discouraging. Getting out of debt is the most difficult step towards financial independence. It is the step where sacrifice sometimes has to be made. Sometimes if feels like it will take forever to get out of debt, but once the debt cycle changes, it gets easier. Every debt paid off helps the savings build faster.

See also, the Mindset of Financial Independence and Three Keys to Reinventing Your Life.

Most Important Activity

Lastly, take the time to tell someone today how much you love them. Every learning course and every mindless activity is worthless without each other. Call a loved one on the phone and talk then call an old friend. Strengthening relationships is the most important door of opportunity that we can open.

Excellent blog. Enjoyed hearing how you are doing. Great tips on finance. And as an aside, LOVE your ring. Trin, you’re crazy. Lol

Thank you Jackie!

Great post. Good finance lessens. Stay safe!

Thank you Susan!

I love that you’re always so positive and looking to improve! Off to check out those online college courses.

Those courses do look tantalizing. Stay safe!

Pingback: Top 10 Personal Finance Articles of the Month — March 2020